- #Monthly expenses spreadsheet google sheets how to#

- #Monthly expenses spreadsheet google sheets update#

- #Monthly expenses spreadsheet google sheets free#

Even though it doesn’t appear by default, you can also underline content by selecting the right cell and using the shortcut CTRL + U.Ĥ – This will allow you to change the colour of the textĥ – This will allow you to change the colour of the cellĦ – This will give you the option to add a border to your cellħ – You can update the alignment of your text. Here you can select whether to present it as a simple number, or as currency (with a currency sign) or as a percentage etc.ģ – In this section, you can make the selected cell Bold and/or Italicised.

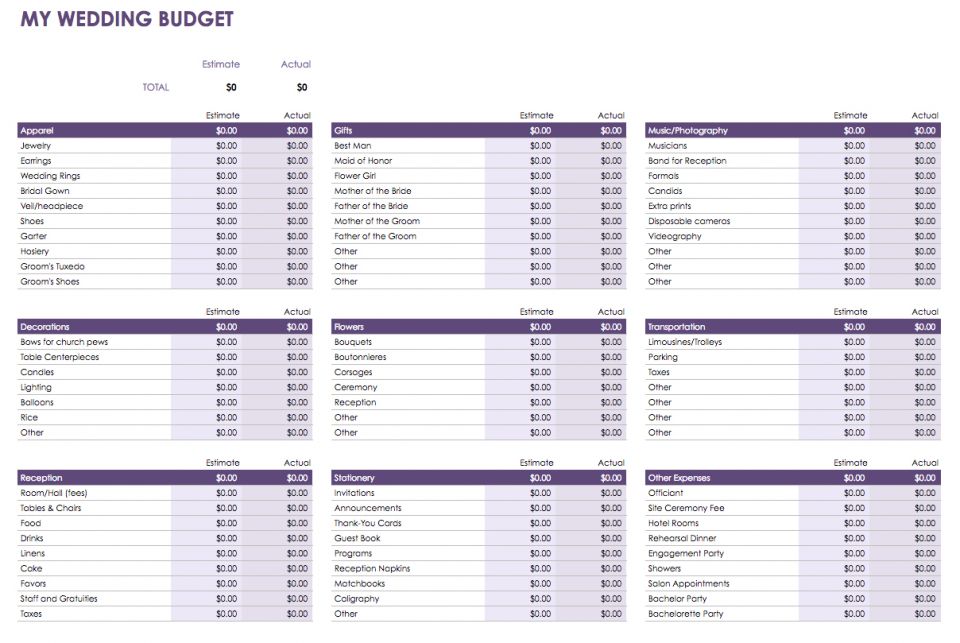

If I simply set my budget wrong, I would update my budget to reflect the higher expected spend in future months.ġ – Cell format type. If this was me, I would start to look at what happened there in the month. Some of their costs actually went up which you would expect to be fairly fixed and easy to forecast such as Rent, Utilities and Insurance which all increased. This was caused mainly by reductions in Transport, Eating Out and Entertainment. Great work to this fiction of my imagination! If you dig into the reason why though, you can see that they actually earned £100 less than they expected.īut they cut back on their expenditure by £155. I’ve entered some dummy figures below, but you can see that total actual savings were £55 higher than was budgeted. And helpfully, you’ll see exactly which categories caused an over or under spend. Once you have entered your actual spend, you’ll be able to see how you did against your budget. The spreadsheet will automatically calculate your Income and Expense totals, along with your net savings and savings rate metrics. Simply enter your actual spend in column D based on the sub-categories. Once the next month has passed, I’m sure you’ll be itching to see how you did against your budget. In the example below, I can do this in Google Sheets using the formula =D3-C3ĭo the same for all of the sub-categories just like you did with the variance calculation. In column E, we want to work out the difference between your actual and your budget, using the formula: This is really handy to understand where you’ve missed your budget, allowing you to give the problem areas more focus for the following months. Calculate the difference between your actual spend and your budget

However, if you want to go one step further and be able to analyse your actual spend versus your budget, then keep on reading.

#Monthly expenses spreadsheet google sheets how to#

I cover in more detail different budgeting techniques such as the 50/30/20 and line-item budgeting in my article about how to budget your salary wisely. You can see that the savings rate is no longer throwing an error, and is saying that this fictional budget is achieving an 11% savings rate, which is £220 per month.Īt this point, the template will allow you to calculate a budget and understand how much money you have left to save each month after all of your expenses are paid for, and what this equates to in a savings rate. The built-in summary tab provides a handy visualisation of your financial standing over the year, allowing you to easily spot any months where your income is going to be lower than your expenses. This is your bank balance at the beginning of the year, as it will then apply your expected/planned saving each month (by taking your expected income minus your expected expenses) to provide you a forecast of your expected end of year balance. On the tab “Setup”, you’ll need to update your “starting balance”. If you wanted to add a completely new category then it will require some changes to the way the spreadsheet has been built, which is out of scope of this article.

#Monthly expenses spreadsheet google sheets free#

This is because the summary tab automatically calculates the sub-total for that category i.e in the screenshot above it will calculate the total for “Insurance”, and so it doesn’t matter if you rename or delete one of the sub-categories such as “Health” underneath it.įeel free to update this to fit your finances. They have quite a comprehensive list of default categories, but if you want to rename or delete certain sub-categories then the summary tab will automatically update.

0 kommentar(er)

0 kommentar(er)